I setup this substack to write about stocks & keep notes but haven’t really gotten around to it. Here is my first write up.

I prefer visuals to long form writing so I have pasted slides about the idea. The full deck is here ——- >

Thesis TLDR - AIM(TSX) is a hold co. run by a hedge fund manager trading at a discount to NAV. The discount will close when they sell their biggest investment and have a cash heavy balance sheet to buy back stock. 63% upside to my base case. Timeline: 3-6 months

Not investment advice DYODD

-Typhon Value

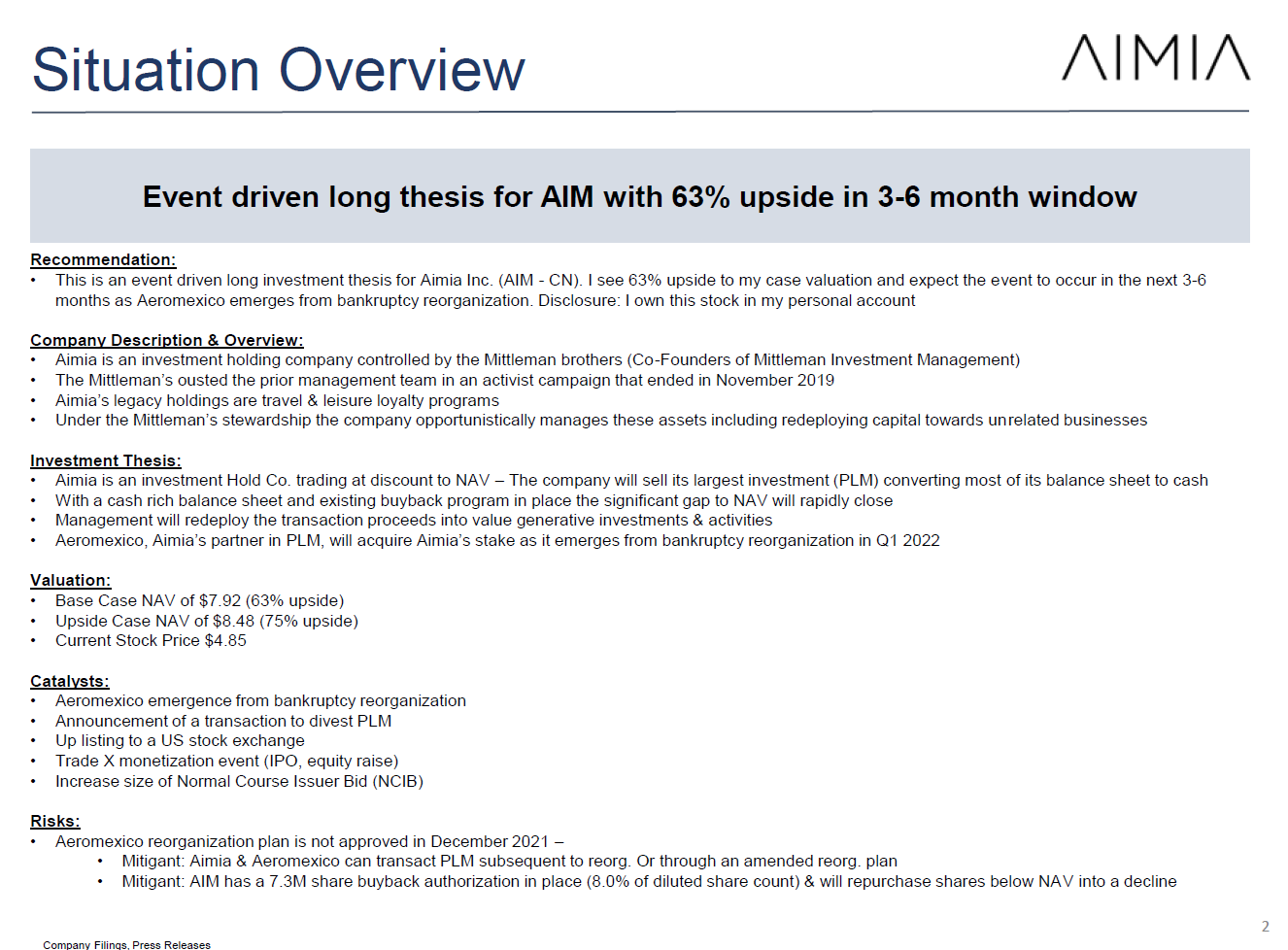

Situation Overview / Thesis:

Thesis is written in the below slide.

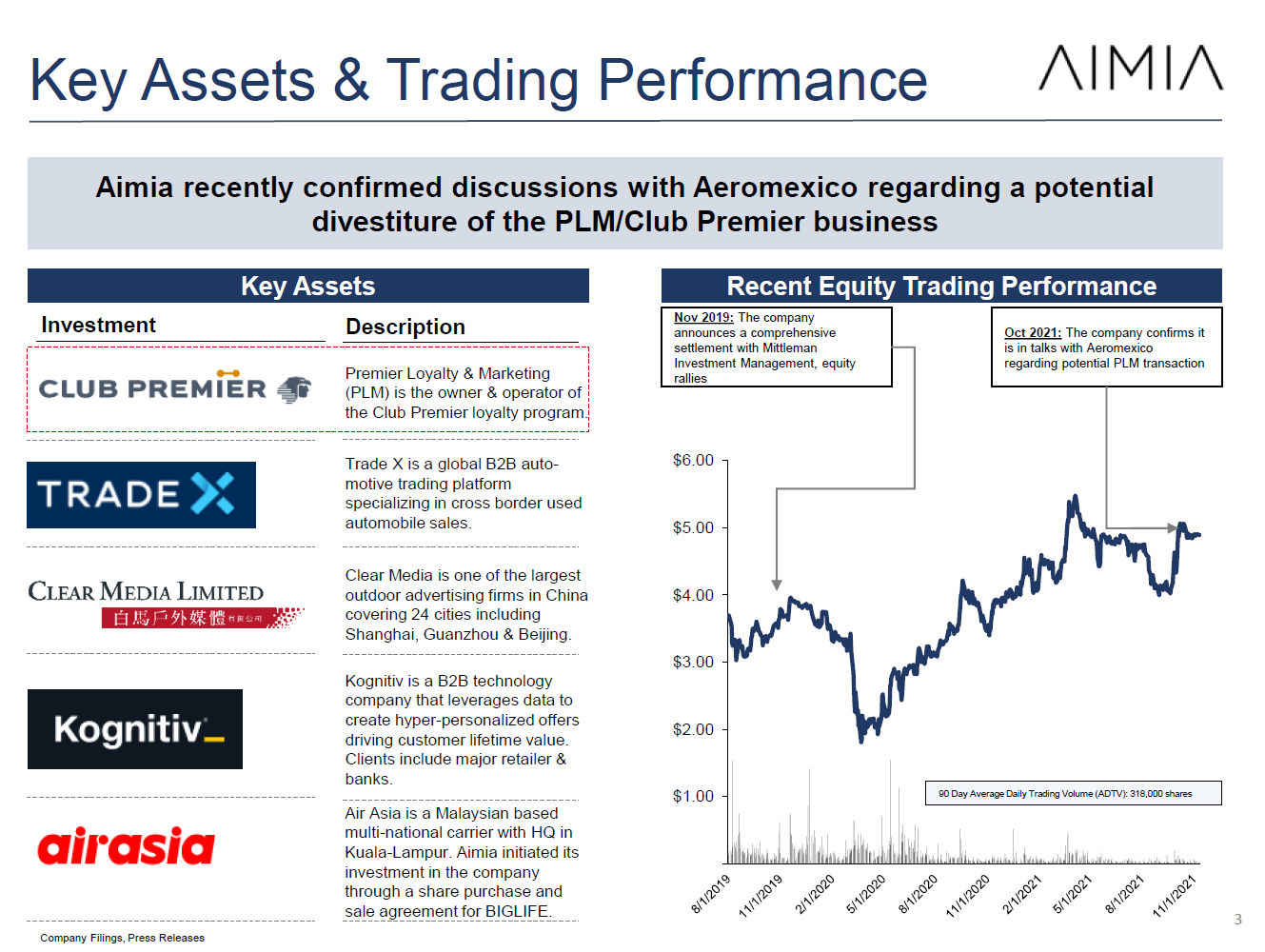

Company Overview - Assets & Stock History:

Aimia has several key assets. Aimia has confirmed they are in talks to sell PLM (highlighted below) to their partner Aeromexico. Details of the transaction can be found in Aeromexico’s bankruptcy filings.

See my NAV calc. below for a breakout of how significant PLM is to Aimia.

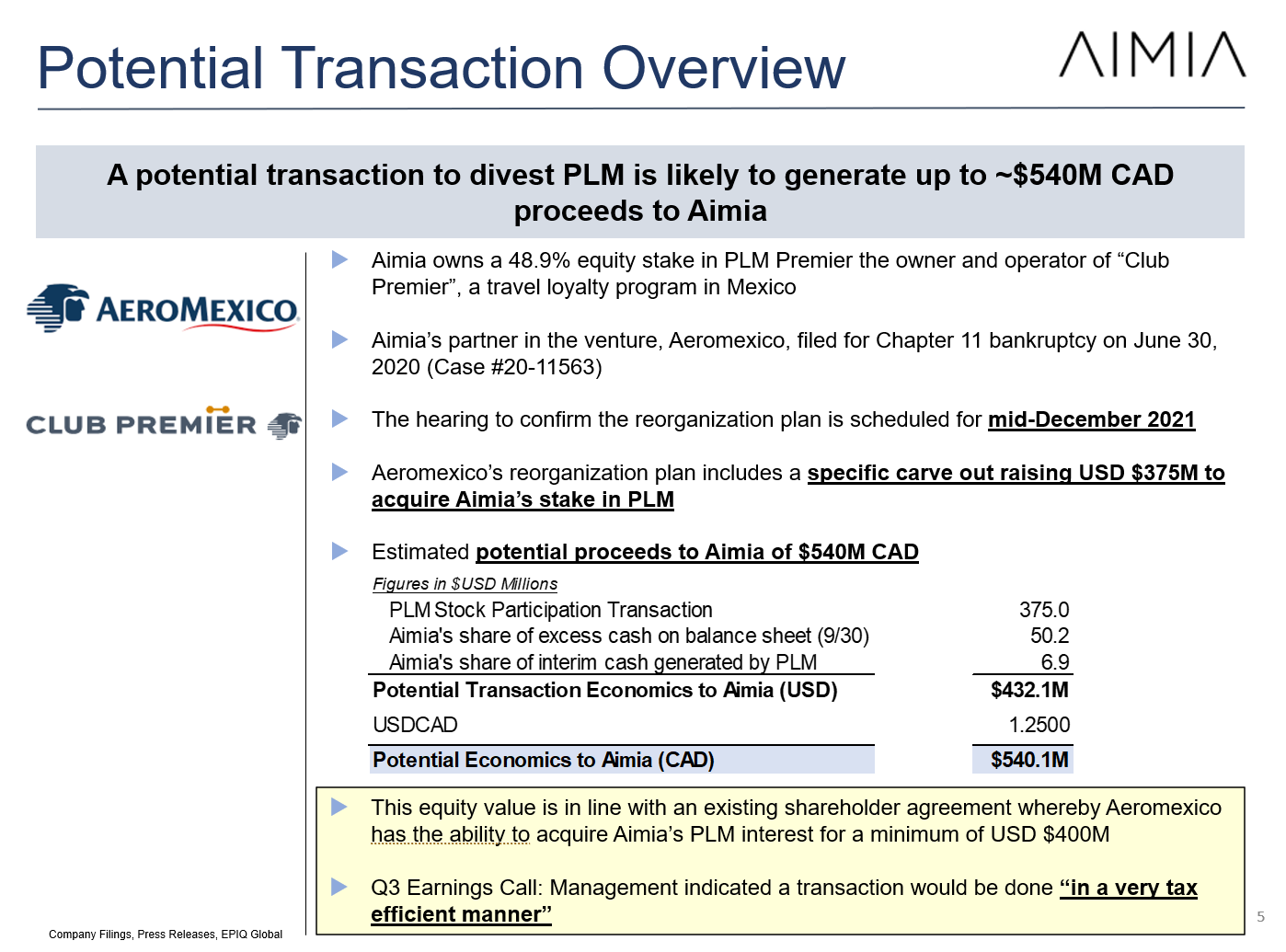

Potential Transaction Overview - The Sale of PLM:

This is what I think a potential transaction will look like - The Aeromexico filings show a $375M USD carve out to purchase Aimia’s stake. If you add excess cash generated by the business and convert to CAD I expect gross proceeds of $540M CAD to Aimia. See the slide below for detail.

This transaction is the crux of my thesis.

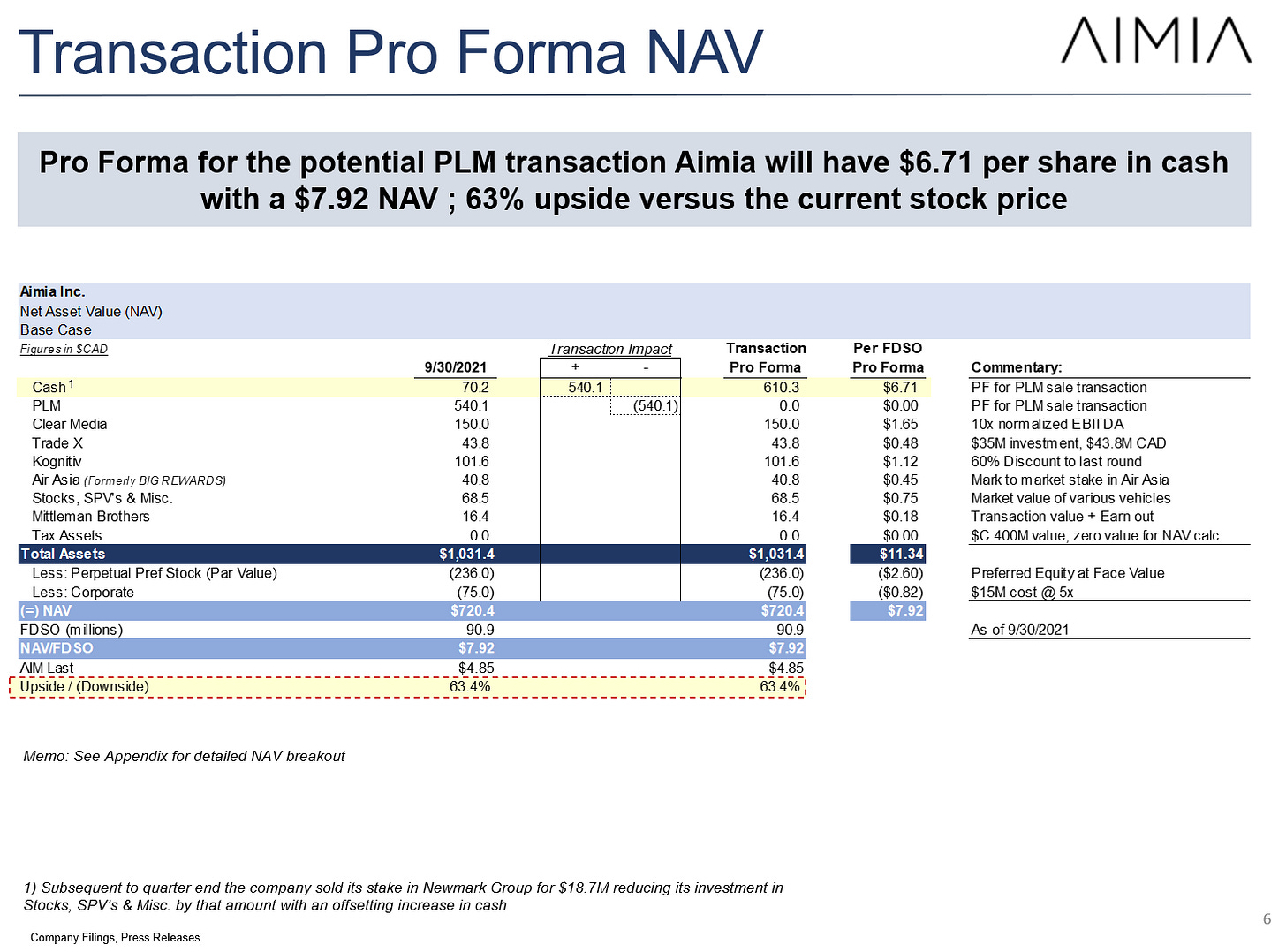

NAV Calc & Transaction Pro Forma:

Pro forma for the transaction Aimia will have a cash heavy balance sheet and the stock will either trade towards NAV or management will use the existing NCIB to retire undervalued shares, forcing the market to converge to NAV.