ATTO - Atento S.A. - Event Driven Long Thesis

Asymmetric trading upside over the next ~12-18 months

Introduction:

ATTO is a popular trading idea on Twitter - This post is my spin on the thesis and dynamics that make for a compelling event driven trade over the next 12-18 months.

This isn’t an original thesis and has been talked about at length elsewhere ; thanks to all the folks on twitter/substack who brought this to my attention.

I prefer visuals to long form writing and have pasted slides to help express my view.

Not investment advice DYODD

- Typhon Value

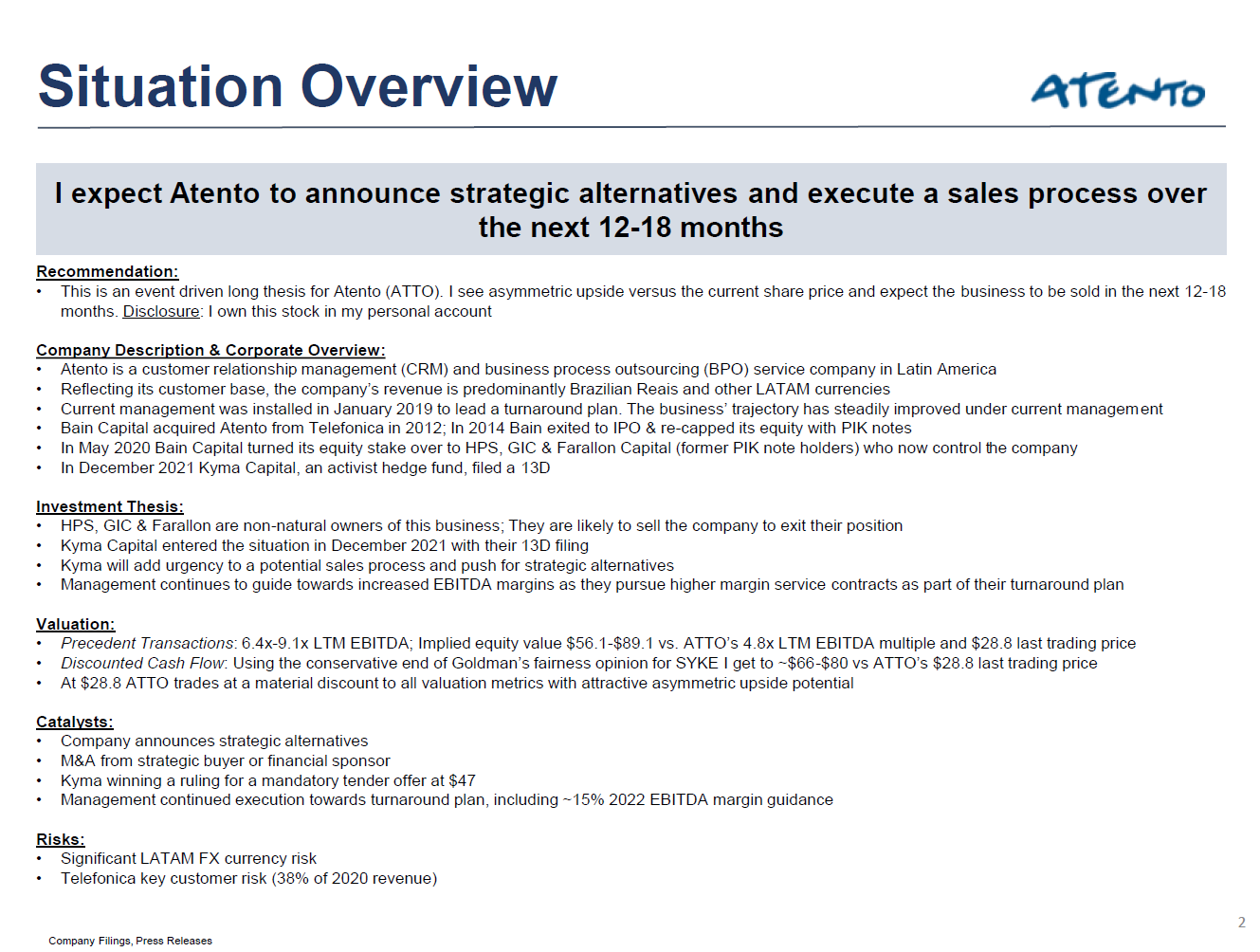

Situation Overview/Thesis:

Detailed thesis is written below - In essence, this company is controlled by 3 HF’s after Bain walked away from their side of the PIK notes in May 2020.

The 3 former PIK note holders are credit hedge funds and therefore not natural owners of this company and likely to sell it to recoup their investment & maximize IRR.

Kyma Capital entered the mix as a public activist in Dec 2021 and I expect them to speed up the sales process timetable. There is not yet a hard catalyst in place but I expect one to emerge through a “Strategic Alternatives” announcement at some point in 2022.

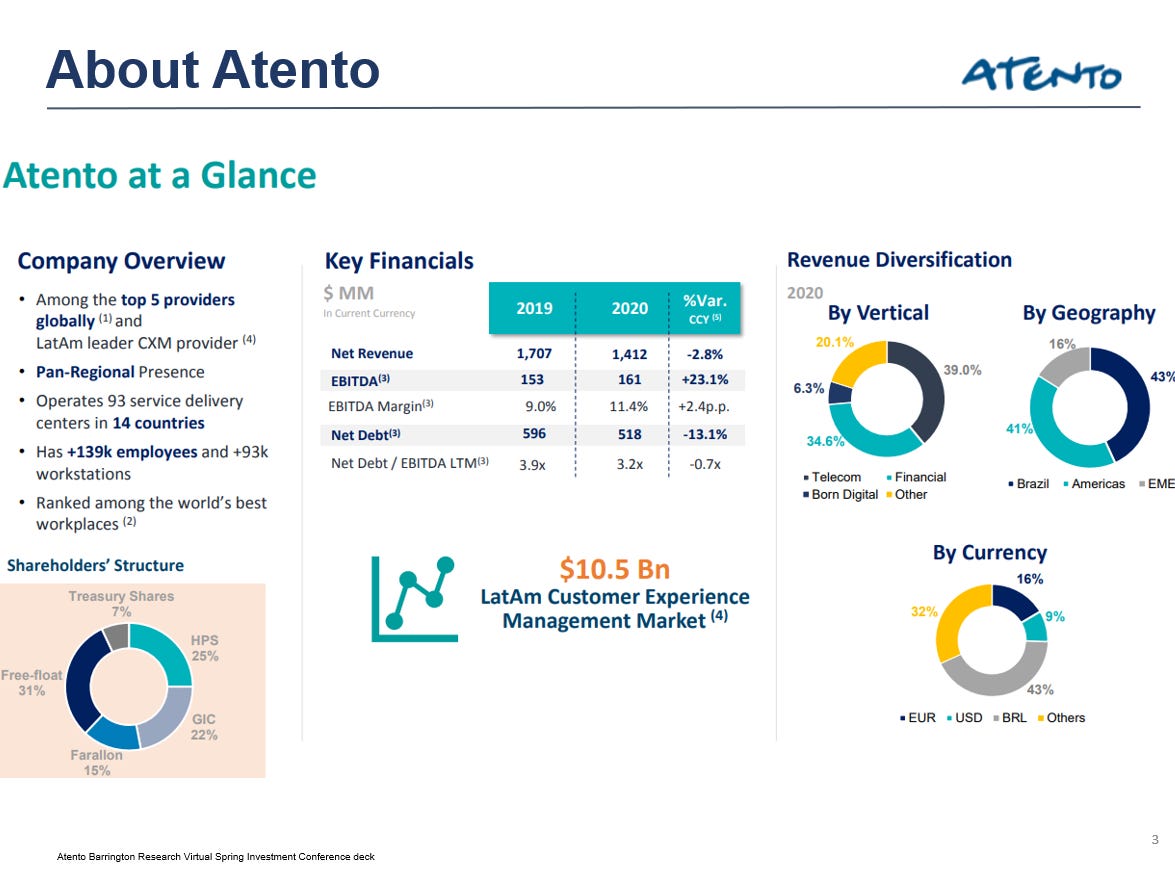

About Atento:

I am not going to spend too much time talking about the business because this is more about the potential deal than a “buy and hold” investment for me.

Candidly, I would be unlikely to invest in this company outside of the current event driven nature.

This is a slide from an IR deck about the company. Atento is a BPO based in Latin America with significant key customer risk to Telefonica (its former parent co.).

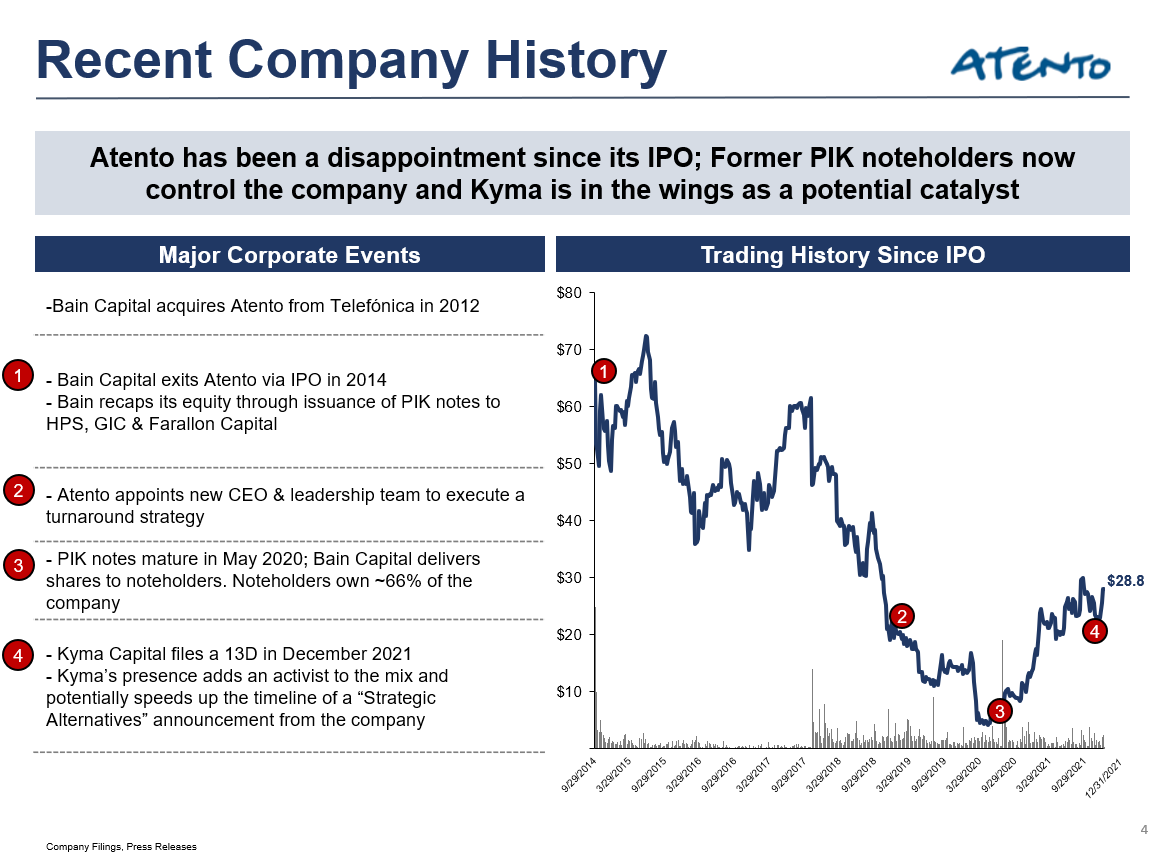

Recent History - Post 2014 IPO:

Bain bought Atento in 2012 from Telefonica

Bain exited its position through an IPO and what was effectively a dividend recap in 2014. To facilitate Bains’ recap HPS, GIC & Farallon bought PIK notes backed by Bain’s Atento equity stake. This was a major de-risking for Bain and a quasi exit.

In May 2020 Bain decided not to refi the PIK notes and surrendered the collateral (Atento equity) to the noteholders.

The various transactions associated with the change of ownership/control form the basis of Kyma’s thesis (to be discussed further down in this post). Kyma has been a shareholder since 2019 and filed a 13D in December 2021.

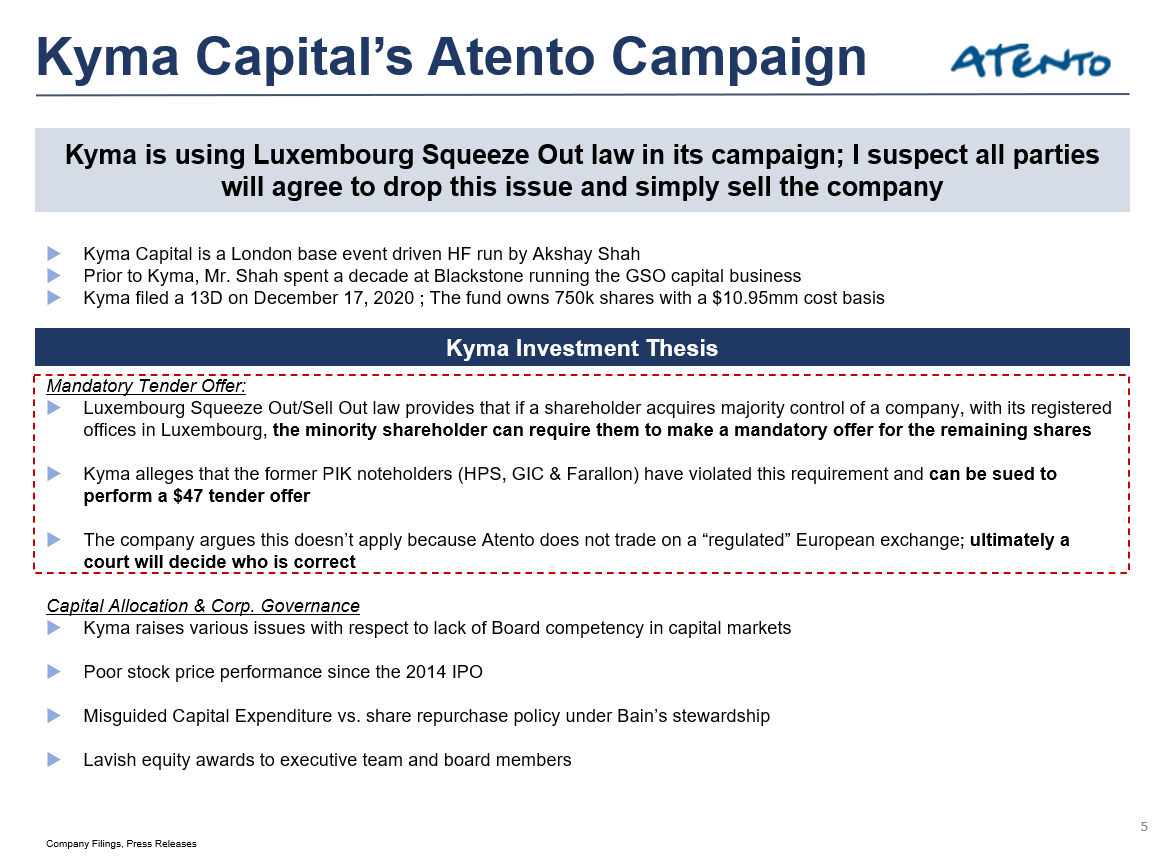

Kyma Capital Activism & Thesis:

Kyma alleges that under Luxembourg squeeze out/sell out law HPS, GIC & Farallon can be forced to tender for Atento shares at their cost basis (Ie. $47)

The company denies this (of course) - The disagreement is around a technical definition of what constitutes a “regulated exchange”. Ultimately, the authorities will decide whether Article 5 of the relevant law is applicable here.

I suspect this will become a side show and Atento will decide to put itself up for sale.

Link to the applicable law is here: (See Article 5)

So, What is Atento Worth?

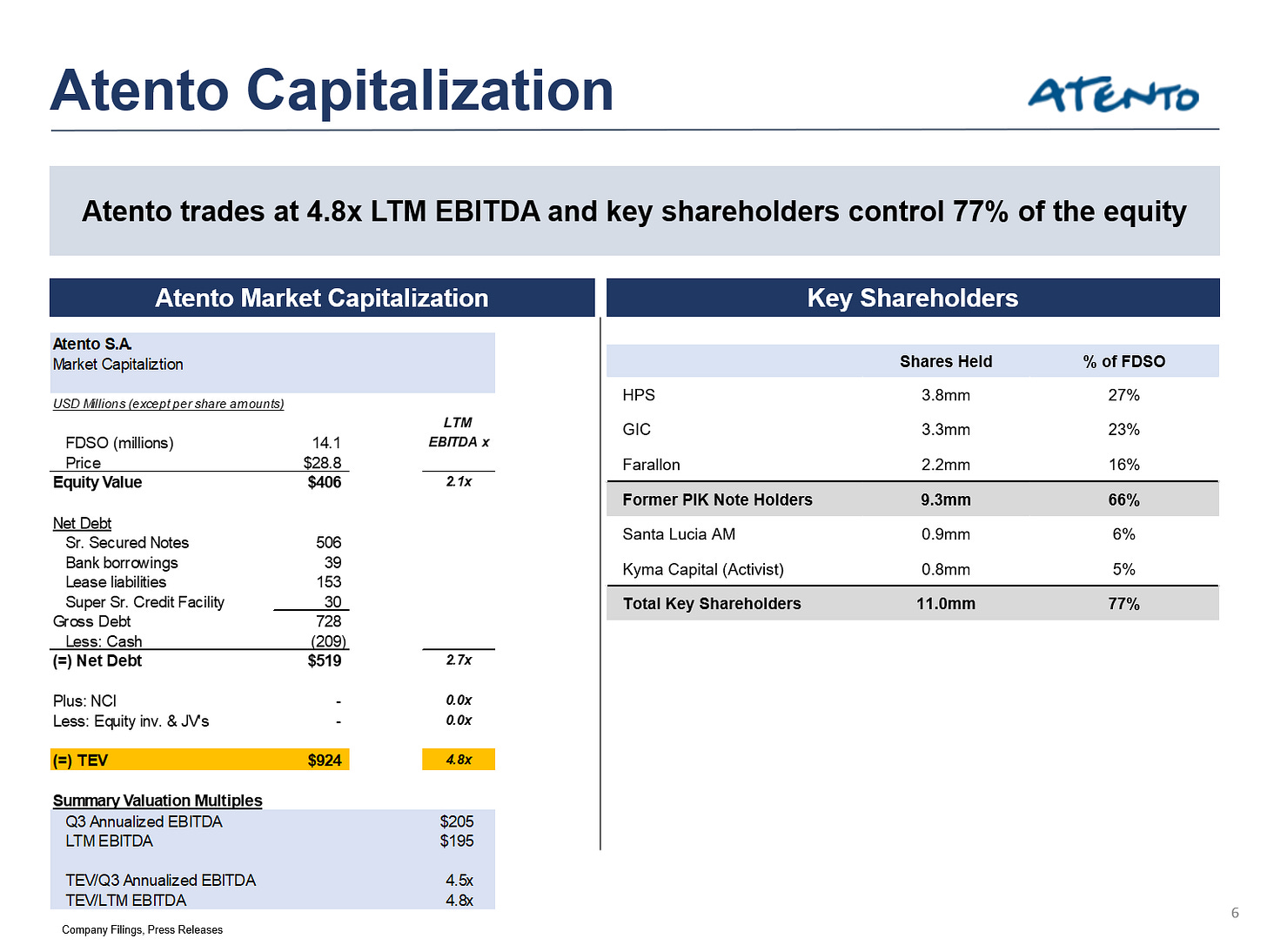

I will attempt to show that Atento, currently trading at 4.8x LTM EBITDA, trades at significant discount to where a banker’s fairness opinion is likely to indicate value.

This will become relevant if we get a “strategic alternatives” announcement from the company.

Roughly 1/2 the TEV is net debt, providing a nice base of leverage to amplify equity upside in the event of a sale at higher TEV/EBITDA multiples (see the next couple of sections for more on this).

Precedent Transactions:

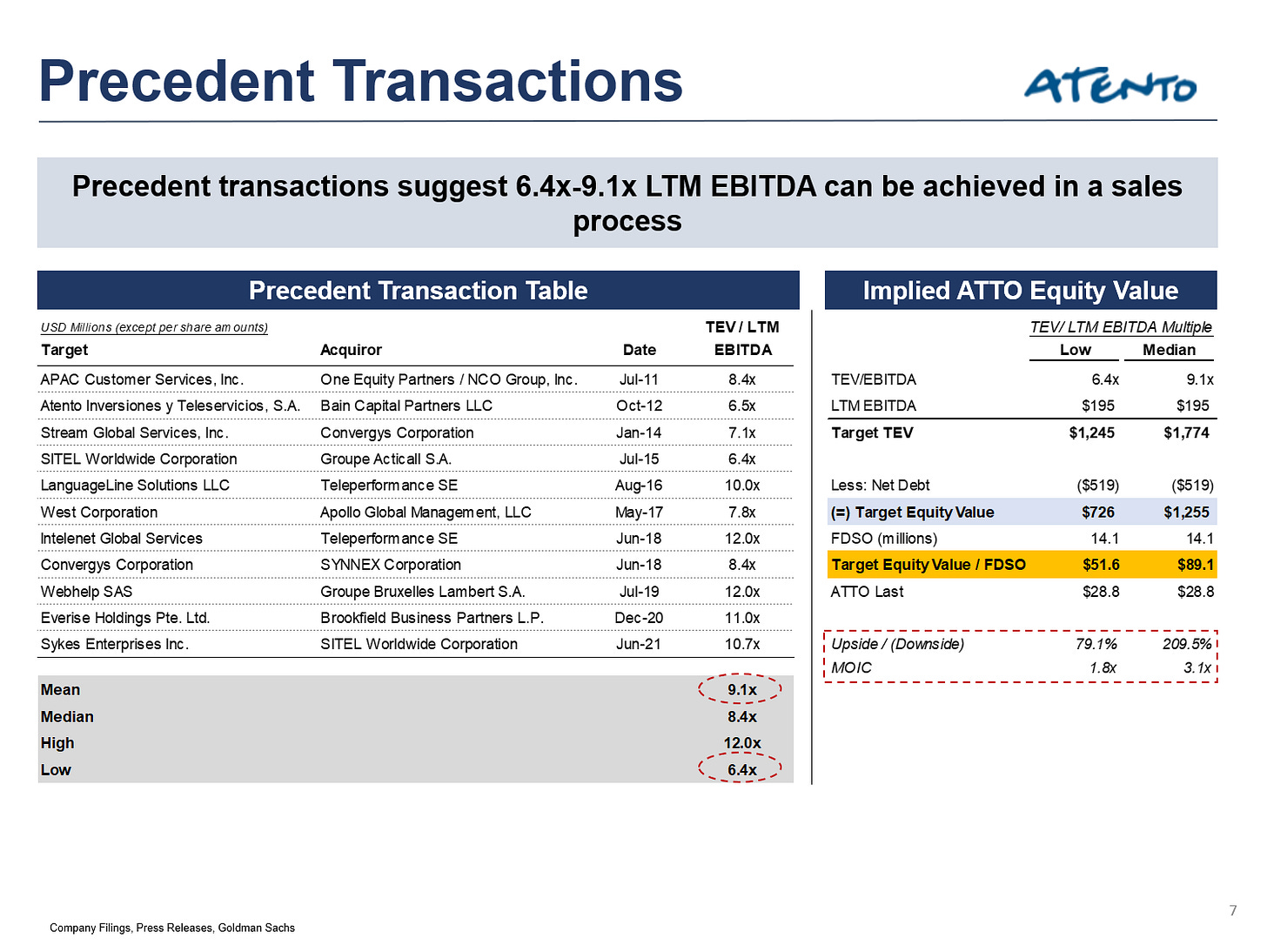

Borrowing from Goldman’s fairness opinion in SYKE’s proxy, the range from minimum-mean LTM EBITDA M&A multiples is 6.4x - 9.1x

This compares favorably to ATTO’s current 4.8x multiple.

While we can’t say for certain where a potential deal would take place, there seems to be a lot of room for upside based on this comp set.

DCF:

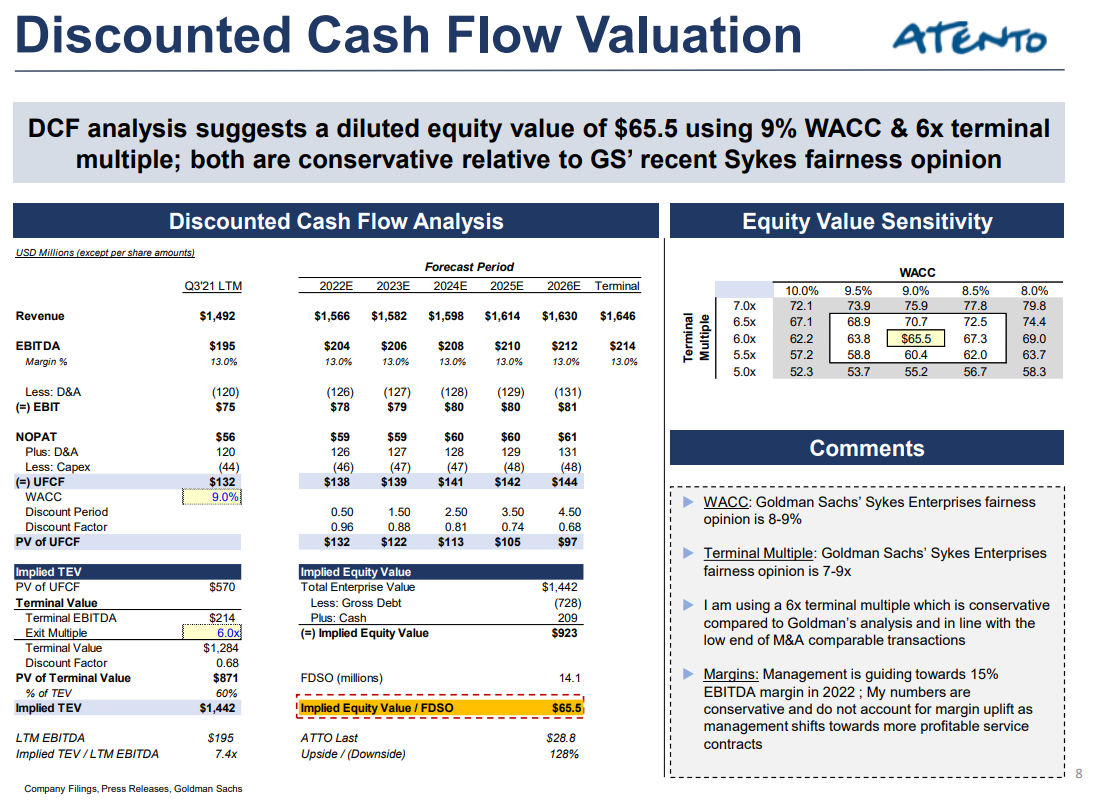

Borrowing again from that same GS fairness opinion, I use the punitive end of the WACC & exit multiple range to arrive at $65.5 (vs $28.8 last trading price for ATTO).

Furthermore, I am not including any upside from continued business momentum, and I am not using management’s 2022 guidance for margins to be 14-15% (1-2% higher than what I modeled).

Putting It All Together:

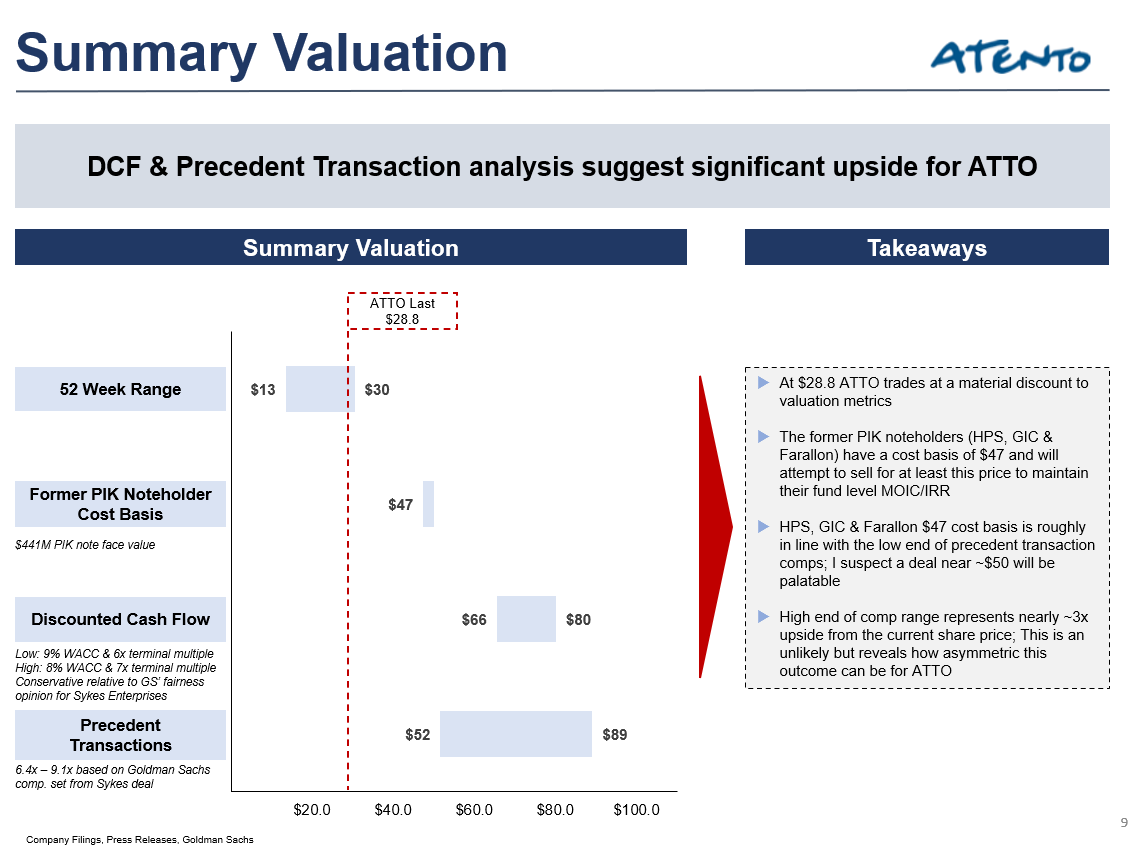

I expect Atento will announce strategic alternatives and go through a sale process during 2022.

DCF and merger comps provide for significant upside vs $28.8 share price at the time of writing.

Further, there is the Luxembourg sell out law “wild card” that could provide an exit at $47.

I expect $47 will be an import anchor in any deal negotiations, and provides an attractive MOIC/IRR vs where the stock trades now.

-

Great writeup! Thanks for providing your calcs too. Summary valuation is a nice touch. Agree with your analysis.